Market Update: ETHUSD & CRUDE OIL – Oct 10th, 2024

NOTE: This Market Newsletter is developed by using Daily Chart Time Frame, and a relevant price chart is attached to each market.

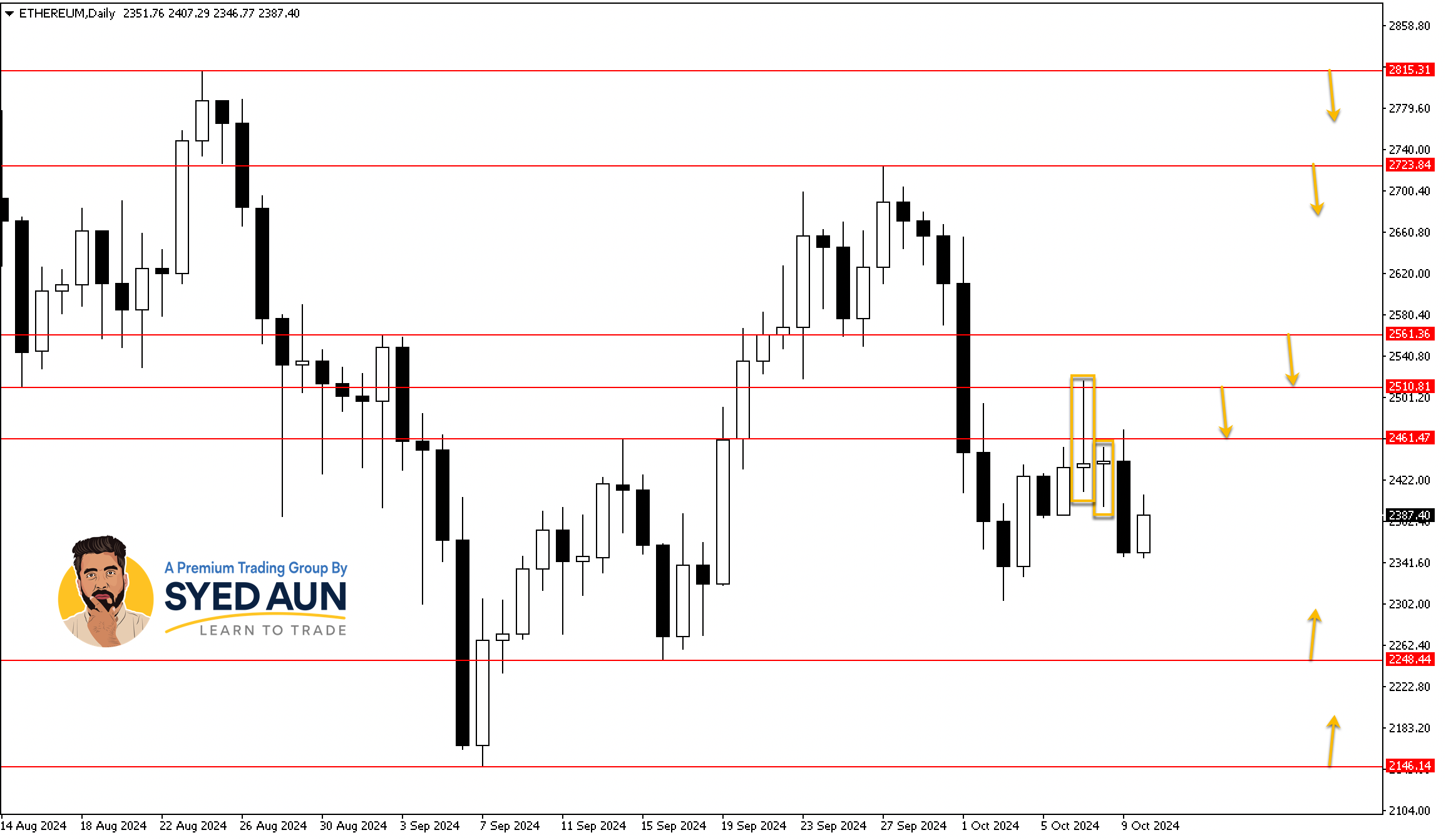

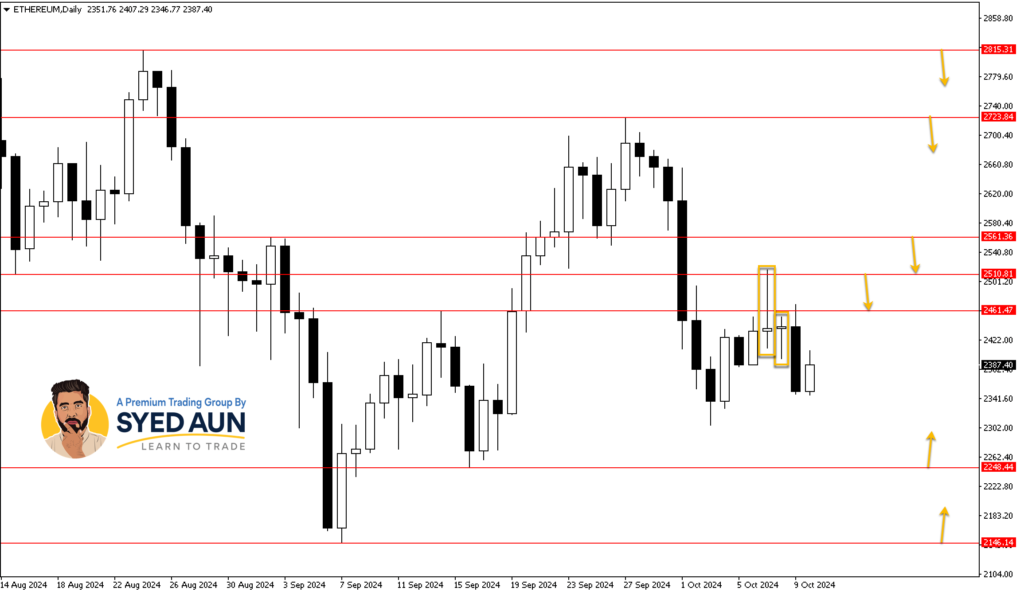

ETHUSD: Selling On Retracement Higher To Within The Range Of Bearish Pin Bar Signal

Comments: The Small Bullish Pin Bar Signal that had formed on Tuesday, Oct 8th failed (We did not consider trading this signal, nor did we mention it).

Price moved lower from the recent Long-Tailed Bearish Pin Bar Signal that had formed just below the $2461 – $2510 short-term resistance area on Monday, Oct 7th (We suggested selling on a retracement higher into the range of this signal in the Tuesday, Oct 8th market newsletter).

Potential Trade Signal: We are looking to sell on a retracement higher to within the range of the recent Long-Tailed Bearish Pin Bar Signal that had formed on Monday, Oct 7th.

Sell Limit: $2470

Stop Loss: $2535

Take Profit: $2430

To Trade This Market With Our Preferred Broker, CLICK HERE

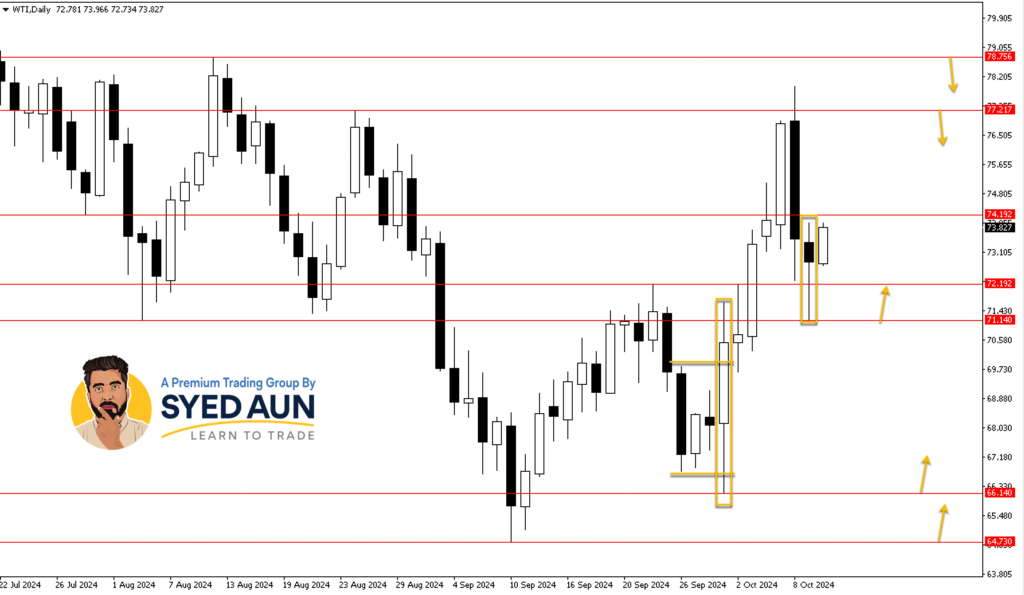

CRUDE OIL: Buying On A Retracement Lower To Within The Range Of Current Bullish Pin Bar Signal

Comments: Price formed a Bullish Pin Bar Signal just above the $71.14 – $72.19 short-term support area, overnight.

Potential Trade Signal: We are looking to buy on a retracement lower to within the range of the current Bullish Pin Bar Signal that had formed overnight.

Buy Limit: $72.20

Stop Loss: $71.00

Take Profit: $74.60

To Trade This Market With Our Preferred Broker, CLICK HERE

We will love to hear your Feedback!

To get access to our Premium Discord & Facebook Groups and get daily updates on 20+ markets – CLICK HERE

Disclaimer: The risk of loss in trading financial market products, like Cryptocurrencies can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Any content posted here should not be considered financial or Trading advice, this newsletter is just for information purposes and is just the author’s opinion.